Wells Fargo

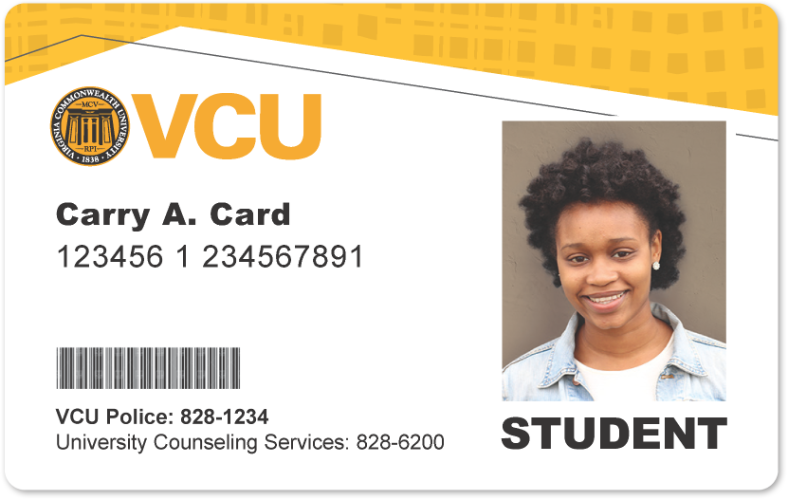

Your VCUCard.

Made exclusively for student life.

Virginia Commonwealth University and Wells Fargo have teamed up to add convenience to your active day with the all-in-one student ID and Campus ATM Card. The VCUCard1 is exclusively for Virginia Commonwealth University students, faculty, and staff.

Link It

Link your VCUCard when you open your Wells Fargo checking account at any Wells Fargo branch. Find a branch near you and schedule an appointment.

On campus or off, you’re ready.

- It’s your official student ID for campus privileges.

- Make purchases using your PIN

- Access ATMs across the U.S., including no-fee cash access at Wells Fargo ATMs, including ATMs on campus.

- Use the Wells Fargo Mobile® app2 to check account activity, deposit checks3, transfer funds4, pay bills, send money with Zelle®5, and set up push notifications, text, or email alerts6.

Visit wellsfargo.com/vcu for more details.

1. The VCUCard is an official school ID and a Wells Fargo Campus ATM Card when linked to a Wells Fargo checking account.

2. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

3. Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

4. Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

5. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not described or as you expected. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle®.

6. Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo may provide financial support to Virginia Commonwealth University for services associated with the VCUCard.

Wells Fargo Bank, N.A. Member FDIC.

Virginia Commonwealth University is not an FDIC-insured depository institution; FDIC deposit insurance only protects against the failure of Wells Fargo Bank, N.A. Member FDIC